http://www.crop.org/CROPNewsEvents/Fiscal-Redistribution-to-Combat-Inequality-and-Poverty-in-Low-and-Middle-Income-Countries.aspx

Eliminating gasoline subsidies in Mexico, wiped out the benefits to the poor from government cash transfers (by John Scott, Research Associate of the CEQ Institute)

Gasolinazo y pobreza: la redistribución incumplida

The first day of the year, our profession lost one of its most brilliant thinkers and fine human beings: Sir Anthony Atkinson. For those of us whose research has focused on inequality and social justice, the loss is incommensurable. Read the tribute from his colleagues at ECINEQ (The Society for the Study of Economic Inequality), of which Tony was the first president: http://www.ecineq.org/image/TonyAtkinsonFinalVersion1.pdf

Nora Lustig presented "Fiscal Redistribution in Low and Middle Income Countries" at OECD's Development Centre in Paris, France.

Click here to view the presentation.

Nora Lustig Shares her Perspective on How to Achieve an Equity Agenda. Interview conducted by OAS's Department of Social Inclusion

Click here to open the video

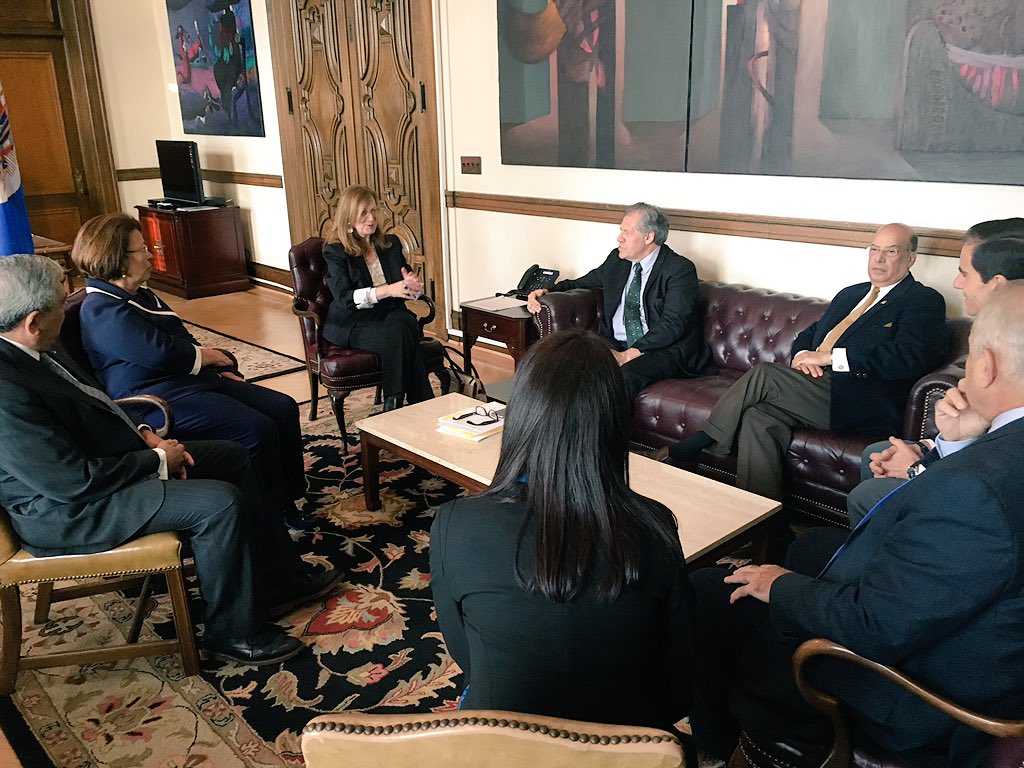

CEQ signed a Memorandum of Understanding with the Organization of American States to deepen the relationship between the two institutions and look for ways to cooperate on joint project, programs and activities in the are of social inclusion, equity and social protection.

Nora Lustig awarded 4.9 million dollars by Gates Foundation for the Commitment to Equity Institute Click Here

On October 29, Stephen Younger presented the CEQ Assessment in Accra, Ghana; click here to see the presentation

Prof. Claudiney Pereira presented the Commitment to Equity methods and cross-country results in Ecuador Workshop "Igualdad y erradicación de la pobreza"

click here

CEQ Training Workshop in Asunción

Tulane doctoral student Sean Higgins training Paraguay's ministry of finance staff on the application of the CEQ methodology at a workshop organized by the World Bank in Asuncion, September 2015.

CEQ New Publications in 2015

Cabrera, Maynor, Nora Lustig and Hilcias Moran. 2015. “Fiscal Policy, Inequality and the Ethnic Divide in Guatemala.”World Development,Vol. 76, pp. 263–279.

Higgins, Sean, Nora Lustig, Whitney Ruble and Timothy Smeeding. 2015. “Comparing the Incidence of Taxes and Social Spending in Brazil and the United States.” Review of Income and Wealth, Published Onlines May 24, 2015, DOI: 10.1111/roiw.12201.

Lustig, Nora. 2015. “Income redistribution and poverty reduction in Latin America: the role of social spending and taxation in achieving development goals,” Development Journal - Society for International Development, Volume 57 Issue 3-4 (Double Issue), September.

Lustig, Nora. 2015. “The Redistributive Impact of Government Spending on Education and Health: Evidence from 13 Developing Countries in the Commitment to Equity Project” Chapter 17 inGupta, Sanjeev, Michael Keen, Benedict Clements and Ruud de Mooij, editors, Inequality and Fiscal Policy, Washington: International Monetary Fund.

Lustig, Nora. 2015. “Inequality and Fiscal Redistribution in Emerging Economies” in Chapter 7 in In it Together: Why Less Inequality Benefits All. OECD Publishing. May.

FUSADES publication with you (Fundación Salvadoreña para el Desarrollo Económico y Social), where CEQ findings were used extensively to support policy proposals. It is available at the Inter-American Development Bank: http://publications.iadb.org/handle/11319/6986 and at fusades.com: http://fusades.com.sv/node/6742

Nora Lustig will serve on the World Bank’s Commission on Global Poverty announced today. The Commission’s mandate is to report on the best ways to measure and monitor poverty and deprivation around the world. Click here

A missing target in the SDGs: Tax systems should not reduce the income of the poor. Click here

CEQ data is featured in the World Bank's LAC (Latin America and the Caribbean) Equity Lab. Click on Fiscal Policy in the menu bar on the left hand side to see the CEQ data in English and Spanish.

Check out Charles Kenny's Center for Global Development blog "Let's Mobilize the Right Domestic Resources for Development."

Charles cites Nora Lustig's Commitment to Equity results.

Check out CEQ Director Nora Lustig's co-authored blog, "The Sustainable Development Goals - Reject Tax Targeting" on the Institute for Development Studies' (IDS) website.

The blog was co-authored by:

- Mick Moore, CEO of the International Centre for Tax and Development (ICTD)

- Nora Lustig, Professor of Economics at Tulane University

- Richard Bird, Professor Emeritus at the University of Toronto

- Nancy Birdsall, President of the Center for Global Development (CGDev)

- Odd-Helge Fjeldstad, Research Director of the International Centre for Tax and Development (ICTD) and Senior Researcher at Chr. Michelsen Institute

- Richard Manning, Senior Research Fellow at the Blavatnik School of Government

- Wilson Prichard, Research Director of the International Centre for Tax and Development (ICTD) and Professor at the Munk School of Global Affairs, University of Toronto

The World Bank's Ethiopia Poverty Assessment 2014 is now available. Chapter 5 summarizes the findings of the CEQ assessment. Click here to access the report.

New CG PartnDership: Commitment to Equity Assessments of Impact of Fiscal Policy

We are pleased to announce a new Commitment to Equity (CEQ)partnership with the Center for Global Development (CGD). CGD works to reduce global poverty and inequality through rigorous research and active engagement with the policy community to make the world a more prosperous, just, and safe place for us all. CGD’s role as a partner of CEQ will be to share the global reach of their communications platform. Through a new Commitment to Equity sub-topic within their inequality topic, they will post links to CEQ studies as they become available, the CEQ papers that are jointly published with CGD, and occasional blog posts. We look forward to working with CGD and are honored to have it as a CEQ partner.

CEQ on the Center for Global Development's Global Prosperity Wonkcast

Please check out the Global Prosperity Wonkcast from May 2014 featuring Dr. Nora Lustig, the CEQ Director. This Wonkcast is produced by the Center for Global Development (CGD) and features international development experts discussing how wealthy countries can promote prosperity in developing counties.

Episode Title:

The Commitment to Equity Assessment (CEQ) - Nora Lustig, May 2014

About the Episode:

Many governments try to reduce poverty and inequality through a mixture of taxes, transfers, and public services. Individual policies, such as taxation or cash transfers, are frequently evaluated on how well they address these goals. But the overall impact of a country’s fiscal policy package on poverty and inequality has rarely been subject to systematic analysis—until now. Nora Lustig, a non-resident fellow at CGD and a professor at Tulane, has set out to close this gap with the Commitment to Equity Assessment or CEQ. I invited Nora to tell us about this new endeavor. Nora explains that the CEQ is both a virtual toolbox—that is, a common analytical approach—and a global network of researchers who are applying this approach in a series of country case studies. CEQ partner institutions include Tulane University, the Inter-American Dialogue, and now CGD, which is helping to bring the approach and the case study findings to a broad international audience. These materials will be collected on a CEQ landing page that is part of the Center’s ongoing work on inequality. The assessment initially focused on Latin America, the region Nora knows best. But with encouragement and funding from the World Bank and the Bill and Melinda Gates Foundation, the CEQ is growing rapidly to include countries in other regions, among them South Africa, Tanzania, Ghana, Tunisia, Armenia, Jordan, Sri Lanka, and Indonesia. What exactly can we learn from such assessments? Nora offers Brazil as an example. Brazil is reputed to be well-run and pro-poor in its policies, especially for direct taxes and cash transfer programs such as Bolsa Familia.

Nora Lustig was appointed Vice-chair of the Board of Directors of the Global Development Network (GDN), a public International Organization that builds research capacity in development globally.

(Spanish) Entrevista a Nora Lustig por el Programa de Género y Diversidad del Banco Interamericano de Desarrollo. ¿Consiguen los impuestos y el gasto social recortar la brecha que existe entre los ingresos de los que más ganan y los que menos, tienen de una forma equitativa para todos los grupos raciales y étnicos? Ver entrevista

Nora Lustig featured in the Latin America Advisor Q & A, “What is the State of Poverty and Inequality in Latin America?”Click Here

New CEQ WP 16 by Higgins, Lustig, Ruble and Smeeding compares the incidence of taxes and transfers in Brazil and the United States Click Here

(Spanish) Entrevista a Nora Lustig por el Banco Interamericano de Desarrollo ¿Por qué los retornos a la educación se han reducido en América Latina? Ver entrevista

Gates Foundation awards US$580,000 to Tulane University to apply the CEQ in Ghana and Tanzania

Nora Lustig --Samuel Z. Stone Professor of Economics, senior associate research fellow at CIPR and nonresident fellow at the Center for Global Development and the Inter-American Dialogue-- has been awarded a US$580,000 grant from the Bill & Melinda Gates Foundation to study the impact of fiscal policy on inequality and poverty in low-income countries.

Lustig is co-founder and director of the Commitment to Equity (CEQ)--a project jointly sponsored by CIPR and the Department of Economics at Tulane University and the Inter-American Dialogue--designed to analyze the impact of taxes and social spending on inequality and poverty, and to provide a roadmap for governments, multilateral institutions, and nongovernmental organizations in their efforts to build more equitable societies (www.commitmenttoequity.org). To date, the project has analyzed and compared the incidence of taxation and social spending in twelve Latin American countries, and studies are currently under way in three additional Latin American countries and six countries in other regions of the world.

The grant will enable Lustig and her team to implement the analysis in two pilot countries in Africa, Ghana and Tanzania, as well as to adapt the CEQ methodology to encompass the idiosyncrasies of low-income countries. She will work alongside co-principal investigators James Alm, Chair of the Economics Department, and Sean Higgins, Economics PhD student.

By undertaking a thorough and transparent analysis of who bears the burden of taxation and who receives the benefits of public spending, the project ultimately hopes to foster evidence-based policy discussion and, ideally, implementation of reforms related to taxation, public spending, and social programs in the two countries.

Commitment to Equity Conference convenes researchers and multilateral organizations;Click here

ICEFI workshop

ICEFI holds a kick-off workshop to launch a rural-urban CEQ in Central American countries with funding from IFAD. For more information click here.

The Brazilian government announced on Monday, July 22, a R$10 billion (about US$4.5 billion) budget cut for 2013. The budget cuts can be divided into two groups:

1) Revision of future outlays. In particular, subsidies especially to agriculture and transfers to social security (about R$4.4 billion).

2) Cuts on discretionary expenditures as travel, electricity, and so on.

Social programs will not be affected and cuts do not affect MINHA CASA, MINHA VIDA program. More details can be found at:

http://www.brasil.gov.br/para/press/press-releases/july-2013/government-announces-r-10-billion-reduction-in-spending-1/view

On June 10-12, the CEQ project joined forces with the Poverty Reduction and Economic Management group of the World Bank to launch pilot studies in Armenia, Ethiopia, Indonesia, Jordan, South Africa and Sri Lanka. To learn more, click here.

CEQ Assessments were presented in LASA, the Inter-American Dialogue and the World Bank in June. Click here if you want to see the presentations

¿Es Argentina un modelo de políticas redistributivas?

¿Es Argentina un modelo de políticas redistributivas? Nora Lustig y Carola Pessino

¿Qué tan comprometidos están los gobiernos de América Latina con la equidad? by Nora Lustig

Taxes, Social Spending and Income Redistribution in Latin America

- Nora Lustig

Fiscal Policy, Equity and Long-Term Growth in Developing Countries

IMF and World Bank Washington, DC – April 21 and 22, 2013

Roundtable discussion on Louisianas Tax Debate

Gov. Jindal has dropped his original tax plan to replace income tax revenue by raising the sales tax rate, extending the sales tax to services and increasing the tax on cigarettes, but his top priority is still to "overhaul the tax code and eliminate income taxes." Professors Jim Alm, Nora Lustig, and Steven Sheffrin discuss implications of changing the tax code. Click here to Download

CEQ Working Paper 13 Now Available

The Working Paper, which is available here, provides an overview of the impact of taxes and social spending on inequality and poverty in Argentina, Bolivia, Brazil, Mexico, Peru, and Uruguay.

CEQ Featured at Colombia Equity Day Event

On March 12, CEQ's work in Colombia was featured prominently in an Equity Day event co-organized by the World Bank and the Government of Colombia. Follow the links below to view the event agenda and the PowerPoint presentation about CEQ.

- Agenda

- PowerPoint Presentation

Brazil eliminates federal indirect taxes on basic needs basket

On March 8, Brazilian President Dilma Rousseff announced the end of federal indirect taxes on all items in the basic needs basket (primarily food), effective immediately. Although basic needs will still be taxed at the state level, this will reduce their cost by between 9.25% and 12.5%, depending on the product. The estimated yearly cost to the government of these tax expenditures is R$ 7.3 billion (about US$3.75 billion). The CEQ study for Brazil has shown that indirect taxes paid by the poor often surpass the cash benefits they receive from the government; this measure will therefore not only reduce inflation but also contribute to reducing poverty.

Listen to President Rouseff: Click here for video

Learn more about the announced policy change:

- Article in Terra

- Article in Epoca Negocios

- Article in UOL Economia

Fiscal incidence studies were completed in seven countries: Argentina, Bolivia, Brazil, Mexico, Paraguay, Peru and Uruguay. Four are in progress: Chile, Colombia, Costa Rica, and Guatemala. Two are in the works: Ecuador and El Salvador.